Investing successfully requires more than luck. It requires data, strategy, and consistent evaluation. One of the most reliable metrics to assess long-term investment growth is the Compound Annual Growth Rate (CAGR). For investors, understanding CAGR can improve decision-making, especially when paired with an online CAGR calculator. These tools make complex calculations simple and allow you to see the real performance of your investments over time.

What Is CAGR and Why It Matters

Breaking Down CAGR

CAGR measures the average annual growth of an investment over a period, assuming profits are reinvested each year. Unlike simple annual returns, CAGR smooths out fluctuations in volatile markets and provides a clear view of long-term performance.

Why Investors Should Care

CAGR is important because it provides a realistic measure of growth over multiple years. It helps investors compare different options objectively, reduces the risk of misinterpreting short-term market swings, and is valuable for planning retirement, savings goals, or portfolio allocation.

How an Online CAGR Calculator Simplifies Investing

Fast and Accurate Results

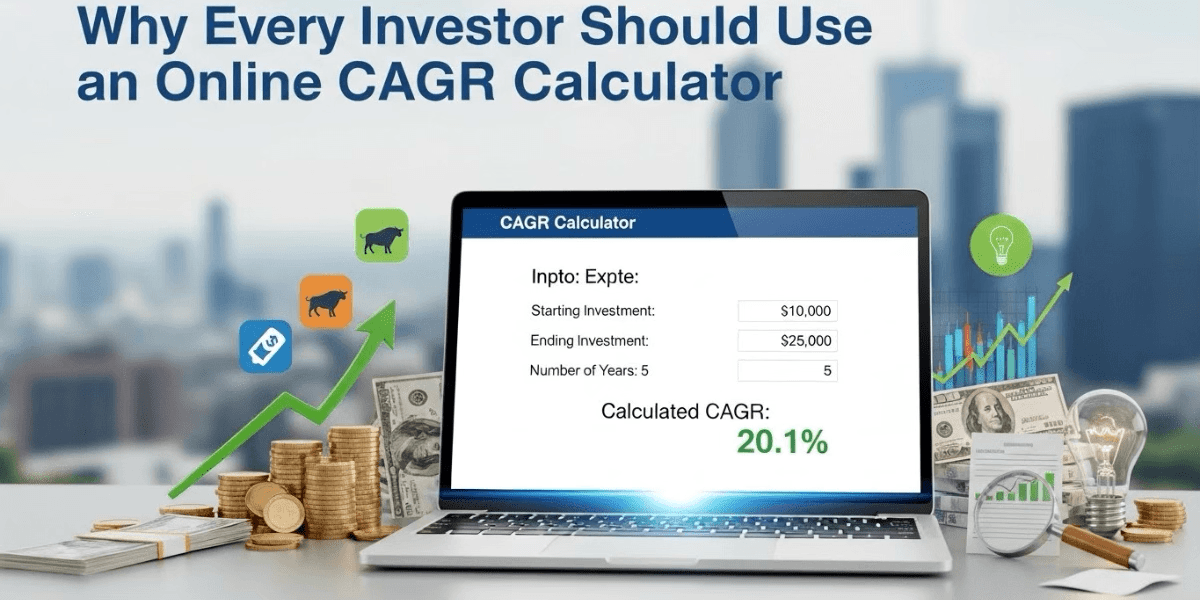

Manual CAGR calculations involve complex formulas that can be confusing. An online CAGR calculator provides instant results and precise growth metrics without errors.

Scenario Planning Made Easy

By entering different initial amounts, final values, or time periods, investors can test multiple scenarios. This helps make informed decisions about increasing contributions or switching investments.

Real-World Applications for Investors

Tracking Stock Performance

For stock investors, CAGR is essential to understand true returns over time. Using a stock calculator USA alongside CAGR analysis allows accurate modeling of U.S. stocks, including dividends, commissions, and fees.

Comparing Funds and ETFs

CAGR is a reliable tool for evaluating mutual funds and ETFs. It normalizes returns over different periods and makes comparisons fair. Investors can identify which funds consistently deliver strong growth.

Step-by-Step Guide to Using a CAGR Calculator

- Enter your initial investment amount

- Input the final value of the investment after your chosen period

- Specify the total duration in years

- Click calculate to see the CAGR

Using Stock Calculators ensures calculations are accurate, user-friendly, and tailored for both U.S. and international markets.

Tips for Better Insights

Factor in commissions, dividends, and fees for realistic results. Test multiple time frames to understand long-term trends. Use CAGR alongside other metrics like ROI or annualized returns for a complete picture of your portfolio.

Common Mistakes Investors Avoid With a CAGR Calculator

- Confusing CAGR with simple average returns

- Comparing investments without considering the same time period

- Ignoring costs, taxes, and reinvested dividends

- Making decisions based on short-term market movements

An online CAGR calculator removes these mistakes by providing clear, consistent, and reliable growth metrics.

Why Stock Calculators Is the Ideal Tool

Stock Calculators offers a full range of tools including an online CAGR calculator and stock calculator USA, designed for investors at all levels. Key benefits include:

- Accurate CAGR calculations for U.S. and international stocks

- Options to include dividends and commissions in growth projections

- Easy-to-use interface suitable for beginners and professionals

- Portfolio simulations to plan long-term strategies

Using Stock Calculators helps investors compare stocks, ETFs, and mutual funds accurately before committing real money.

Understanding the long-term growth of your investments is critical for financial success. A CAGR calculator online simplifies calculations, provides clarity, and helps you plan better. Platforms like Stock Calculators, which include stock calculator features, empower investors to make smarter decisions, compare options accurately, and stay on track toward long-term financial goals.

Incorporating CAGR into your investment analysis reduces guesswork, prevents errors, and supports confident portfolio growth over time.

Calculate Your Investment Growth Rate

Ready to analyze your investment performance? Use our free CAGR calculator to see how your investments have grown over time.